Australian power station energy storage profit model

Welcome to our dedicated page for Australian power station energy storage profit model! Here, we have carefully selected a range of videos and relevant information about Australian power station energy storage profit model, tailored to meet your interests and needs. Our services include high-quality solar container products and containerized PV solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Australian power station energy storage profit model, including cutting-edge solar container systems, advanced containerized PV solutions, and tailored solar energy storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial containerized systems, or mobile solar power solutions, we have a solution for every need. Explore and discover what we have to offer!

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Request Quote

Battery storage profitability looking up in Australia, driven by power

Investments in battery storage within Australia''s National Electricity Market (NEM) are increasingly profitable due to higher power price volatility and changing market dynamics,

Request Quote

Pumped Hydro Storage in Australia

The Benefits of Pumped Hydro in Australia Australia already boasts a pumped hydro fleet of about 1.6GW across the Wivenhoe, Tumut 3 and Shoalhaven power stations, with an additional

Request Quote

Australia: The 2025 NEM Battery Energy Storage Pipeline Report

Australia has a massive pipeline of grid-scale battery energy storage projects. 16.5 GW of new battery projects could arrive in the NEM in the next 3 years.

Request Quote

Energy storage

The ESCRI-SA Dalrymple 30MW battery project illustrates a potential commercial model for large scale energy storage systems which provides both regulated and unregulated revenue

Request Quote

Australia: 2GWh of energy storage reaches financial

The largest energy storage system to reach financial commitment in Q2 2024 was the 1,200MWh Stanwell Big Battery in Queensland, to be built

Request Quote

Energy Storage Profit Model Analysis Report

Study on profit model and operation strategy optimization of energy storage With the acceleration of China''''s energy structure transformation, energy storage, as a new form of

Request Quote

Energy storage profit model lacks policy support

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three

Request Quote

Configuration and operation model for integrated

This article first analyses the costs and benefits of integrated wind–PV-storage power stations. Considering the lifespan loss of energy

Request Quote

Australia: What did batteries earn in the NEM in 2024?

Grid-scale battery energy storage in the Australian NEM earned an average of $148k per MW in 2024. This marked a 45% increase from the low reached in 2023. But behind that topline

Request Quote

Study on profit model and operation strategy optimization of energy

Download Citation | On Sep 22, 2023, Peng Yuan and others published Study on profit model and operation strategy optimization of energy storage power station | Find, read and cite all the

Request Quote

Introducing the ME BESS AUS NEM Index

The ME BESS AUS NEM Index captures the real-world performance of grid-scale battery storage - tracking revenues across all merchant revenue streams at a

Request Quote

Storage across the NEM

Converting decommissioned power stations into large-scale battery storage is proving an efficient way to capitalise on existing electrical

Request Quote

Unlocking the Business Profit Model of Energy Storage: Key

The bottom line? Energy storage isn''t just about electrons – it''s about creating value at every twist and turn of the power curve. Whether you''re a grid operator drowning in solar noon excess or

Request Quote

AGL Energy dedicates AU$900m to energy storage as net profit

AGL Energy has deployed approximately AU$900 million toward BESS and renewables in Australia during the fiscal year ending June 2025.

Request Quote

Introducing the ME BESS AUS NEM Index

The ME BESS AUS NEM Index captures the real-world performance of grid-scale battery storage - tracking revenues across all merchant revenue streams at a five-minute granularity.

Request Quote

New South Wales approves 2GWh BESS at coal-fired

The BESS will be located adjacent to the 1,400MW Mount Piper black coal-fired power plant. Image: EnergyAustralia. Australia''s New South

Request Quote

Australia Energy Storage Market Analysis: Profit Models,

Australia''s energy storage market began its journey in 2016, driven by key factors such as weak grid infrastructure, abundant renewable energy resources, and high electricity prices for

Request Quote

Storage across the NEM

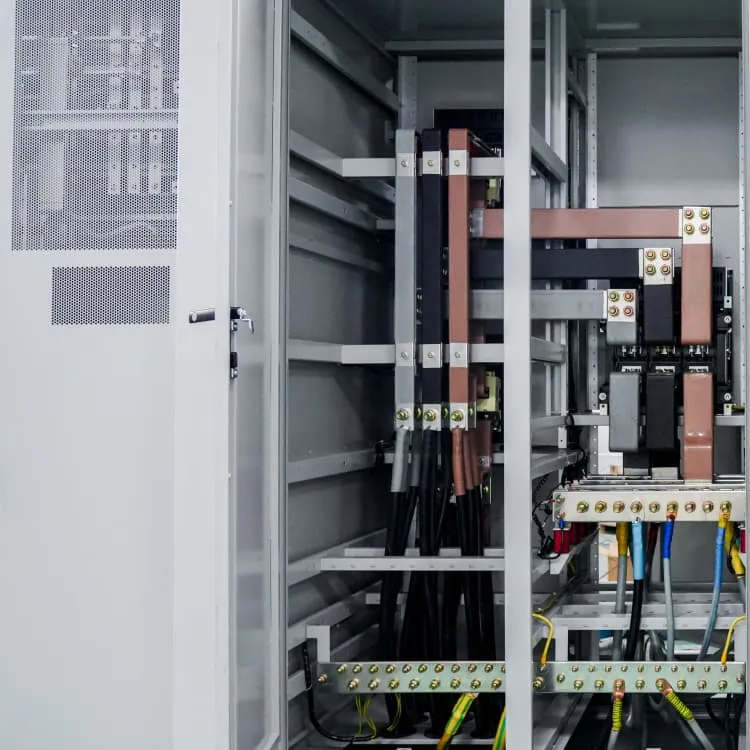

Converting decommissioned power stations into large-scale battery storage is proving an efficient way to capitalise on existing electrical infrastructure (e.g. switchyards). The

Request Quote

Australian battery storage sector

Whilst, at least in the short term, Frontier believes energy storage will be included within an overall portfolio context, we have met with managers looking at energy storage-specific investment

Request Quote

What Is the State of Virtual Power Plants in Australia?

Executive Summary A Virtual Power Plant (VPP) is the aggregation of supply and/or demand response from Distributed Energy Resources (DER) such as batteries and smart appliances to

Request Quote

UNDERSTANDING THE BESS MARKET IN AUSTRALIA

The increase in energy consumption, driven by rapid electrification, data consumption and AI, coupled with Australia''s supportive regulatory policies and record low renewable energy

Request Quote

Energy Storage System Integration Profit Model: Unlocking

Why Energy Storage Integration Is Becoming a Profit Powerhouse You know, the global energy storage market is projected to hit $435 billion by 2030 - but here''s the kicker: 68% of potential

Request Quote

Study on profit model and operation strategy optimization of energy

With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absorption, frequency modulation and

Request Quote

How BESS helps Generate Revenue in Australia''s Energy Market

Discover how Battery Energy Storage Systems (BESS) can generate revenue in Australia''s energy market through FCAS, energy arbitrage, network support, and demand response.

Request Quote

UNDERSTANDING THE BESS MARKET IN AUSTRALIA

The Australian Battery Energy Storage Systems (BESS) market has attracted significant investment interest due to its crucial role in supporting renewables penetration and ensuring

Request QuoteFAQs 6

How can battery energy storage systems generate revenue in Australia?

Discover how Battery Energy Storage Systems (BESS) can generate revenue in Australia's energy market through FCAS, energy arbitrage, network support, and demand response.

Can battery energy storage systems be used in Australia?

In Australia, the National Electricity Market (NEM) and the Western Australian Wholesale Electricity Market (WEM) both have provisions for battery energy storage systems to participate in the provision of Frequency Control Ancillary Services (FCAS) and other network services.

Why is battery storage a good investment in Australia?

However, the report finds that high daily price volatility in power markets makes battery investments appealing even without government guarantees. “Battery storage will be crucial in Australia’s energy transition, influenced by the growth of renewable energy and market volatility.

Will energy storage transform Australia's energy generation mix?

Following the recent unprecedented renewable energy boom, 2019 is set to focus on how renewables can transform Australia’s energy generation mix. This is not being driven by ideology, but by economics. Energy storage will play an important role in this transformation.

Does Australia support energy storage infrastructure?

The Australian government strongly supports energy storage infrastructure though the Capacity Investment Scheme and NSW Energy Infrastructure Roadmap, with highly competitive biannual tenders offering revenue underwriting to attract investment and ensure financial stability in a volatile market.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Related reading topics

- Profit model of flywheel energy storage power station

- Liberia Energy Storage Power Station Profit Model

- Dominican Republic Energy Storage Power Station Profit Model

- Australian Charging Market Station Energy Storage Project

- Australian energy storage power generation project

- Australian corporate power generation and energy storage

- South Korea s independent energy storage power station

- Huawei Energy Storage Power Station Sub-project