What is the tax rate for outdoor power supply

Welcome to our dedicated page for What is the tax rate for outdoor power supply ! Here, we have carefully selected a range of videos and relevant information about What is the tax rate for outdoor power supply , tailored to meet your interests and needs. Our services include high-quality solar container products and containerized PV solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to What is the tax rate for outdoor power supply , including cutting-edge solar container systems, advanced containerized PV solutions, and tailored solar energy storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial containerized systems, or mobile solar power solutions, we have a solution for every need. Explore and discover what we have to offer!

VAT rates on different goods and services

A list of goods and services showing which rates of VAT apply and which items are exempt or outside the scope of VAT.

Request Quote

Identifying State-Focused Renewable Energy Tax Exemptions

Numerous states have either a solar or wind tax exemption, meaning that equipment used for electricity generation by either solar arrays or wind farms is exempt from

Request Quote

Sales Tax Exemption in Texas on Electricity Bills

Grant Thornton shares perspectives on sales and use tax issues for renewable generation facilities, energy storage and electric vehicle charging stations.

Request Quote

Sales Tax Exemptions for Energy Expenses – emsenergy

Sales tax exemptions on electricity, natural gas, propane, steam, and water can be a big source of savings: most companies reduce their monthly utility bills by 4-6%.

Request Quote

Sales Tax Exemption in Texas on Electricity Bills

5 days ago· Yes, there is sales tax on electricity in Texas. Residential customers are exempt from paying sales tax on electricity. Commercial customers in Texas pay sales tax of 6.25 to 8.25%

Request Quote

Electrical Improvements Depreciation Life: How to Classify and

Learn how to classify and deduct electrical improvements by understanding depreciation life and recovery periods for accurate financial management. Understanding how

Request Quote

Electricity Duty

Electricity Tax in India - Know all about electricity duty in India, covering taxation on electricity bills, tariff policies, and application across states.

Request Quote

Utility Sales Tax 101

The utility sales tax exemption is available in 31 States (see map). The exemption applies when utilities are recognized as necessary and integral to a business''s production

Request Quote

GST on Catering Services & Banquet Halls: Rates

Understand GST on catering services and GST on banquet hall with Vakilsearch. Learn applicable GST rates, tax implications, and compliance requirements

Request Quote

GST on Air Conditioners: AC HSN Code and GST Rate

GST Rate and HSN Code of Air Conditioners: Find out the rate of GST on air conditioners, HSN codes applicable, impact due to the implementation of GST, the value of supply and

Request Quote

What is the invoicing tax rate for energy storage power stations?

The invoicing tax rate for energy storage facilities depends on a confluence of local tax laws, eligibility for incentives, and the specific configuration of the energy system.

Request Quote

Oregon Rates and Tariffs

This section contains rules/regulations and tariff schedules that are currently in effect. PacifiCorp seeks to keep this information accurate and current. However, the only tariffs that are actually

Request Quote

GAIN ON POWER SUPPLY CONTRACT IS FROM SALE OR

The Service has ruled in technical advice that the proceeds a partnership received on the transfer of a power supply contract qualified as gain from the sale or

Request Quote

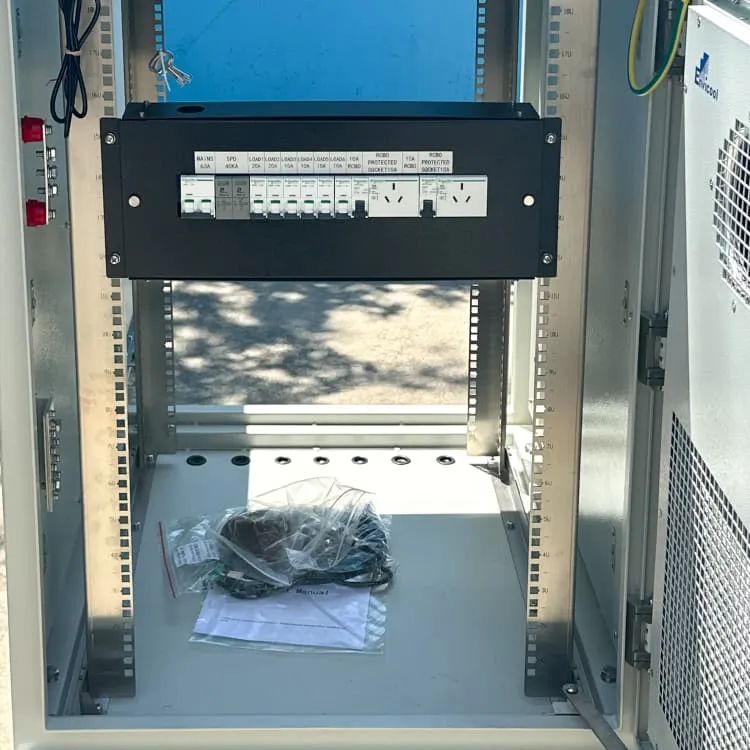

Outdoor power supply

With the increase of people''s outdoor camping activities, outdoor power supply is the best choice to realize the freedom of electricity. The

Request Quote

Manufacturing and Research & Development Exemption Tax

Development Exemption Tax Guide California is home to many innovative businesses and organizations that create jobs and contribute to the state''s economy. A partial sales and use

Request Quote

NAICS 444230

NAICS Code 444230 is a North American Industry Classification System (NAICS) 6-digit code that defines a "National Industry" for Outdoor Power Equipment Retailers. • Retailing new lawn and

Request Quote

Sales tax implications in green energy

Grant Thornton shares perspectives on sales and use tax issues for renewable generation facilities, energy storage and electric vehicle charging stations.

Request Quote

GST on Supply of Electricity – Insights

Further, when supply of electricity combined with some other service elements to the customers, whether tax would be payable or not on such

Request Quote

SALT and Battery: Taxes on Energy Storage

This article summarizes the differing property tax and sales tax considerations regarding BESS and takes a deep dive into four states with significant BESS development

Request Quote

Utility Sales Tax 101

The utility sales tax exemption is available in 31 States (see map). The exemption applies when utilities are recognized as necessary and integral

Request Quote

GST rates on solar power based devices and systems

All renewable energy devices, including solar devices or solar power projects, are covered under the ambit of GST. This article throws light

Request Quote

Understanding Sales Tax on Equipment Rentals – A Clear Guide

Check the combined state and local tax rates for where your equipment will be used. Tax rates change depending on the area, so it''s important to get it right.

Request Quote

Renewable Electricity Production Tax Credit Information

For these projects, the tax credit starts at a base of 0.3 cents/kWh or 0.55 cents/kWh, depending on renewable energy type as noted above, but they qualify for the full

Request Quote

Renewable Electricity Production Tax Credit Information

For these projects, the tax credit starts at a base of 0.3 cents/kWh or 0.55 cents/kWh, depending on renewable energy type as noted above, but

Request Quote

News

The capacity of the battery. So the larger the battery capacity of an outdoor power supply, the longer it will last. Here''s the difference between mAh and Wh by the way: The battery capacity

Request Quote

Identifying State-Focused Renewable Energy Tax

Numerous states have either a solar or wind tax exemption, meaning that equipment used for electricity generation by either solar arrays

Request Quote

GST on Catering, Restaurant & Hotel Accommodation Service

GST on restaurant Service Restaurant Service means supply, by way of or as part of any service, of goods, being food or any other article for human consumption or any drink,

Request QuoteFAQs 6

Do I have to pay sales tax on commercial electricity?

However, depending on the type of business you operate, you may be exempt from paying sales taxes on your commercial electricity. Electricity is exempt from sales and use taxes when the electricity is used for specific manufacturing or production purposes. You may be eligible for a sales tax exemption if you are in these businesses:

Which states exempt electricity from sales tax?

An exemption taxpayers should examine is whether electricity is at retail or for resale. For example, Pennsylvania and Texas exempt electricity sales from sales tax if it is used during the manufacturing process, and Pennsylvania exempts sales tax if electricity is purchased for residential use.

When is electricity exempt from sales and use taxes?

Electricity is exempt from sales and use taxes when the electricity is used for specific manufacturing or production purposes. You may be eligible for a sales tax exemption if you are in these businesses: Companies that operate large residential facilities may also qualify for an exemption.

How will state taxes affect renewable generating companies?

This increase in renewable generating companies will have state tax implications. “States may impose several taxes on renewable generation companies, including income tax, franchise tax, capital stock tax, gross receipts tax, property taxes and sales and use taxes,” Wade and Herzberg wrote.

Does a bundled electricity sale qualify for a sales tax exemption?

If sold together in a bundled transaction, taxpayers should determine whether the electricity or REC is the true object of the transaction. Taxpayers with battery storage at their facility should determine whether storing and releasing electricity could qualify for a production exemption from sales tax.

Does Texas have a sales tax exemption for energy use?

Texas has implemented a sales tax exemption for energy usage that applies to certain types of manufacturing businesses and residential communities: Should your business qualify, you’ll be exempt from paying state and local taxes on any electricity and natural gas used to manufacture, process or fabricate a physical product.

Related reading topics

- What is the use of 100 degrees outdoor power supply

- What is the appropriate size of an outdoor power supply

- What parts does an outdoor power supply include

- What does it mean to check on outdoor power supply

- What size should I choose when buying an outdoor power supply

- What is needed to produce outdoor power supply

- What is the brand of outdoor power supply in Guatemala

- What size outdoor power supply is recommended