Qatar photovoltaic module export tax rate

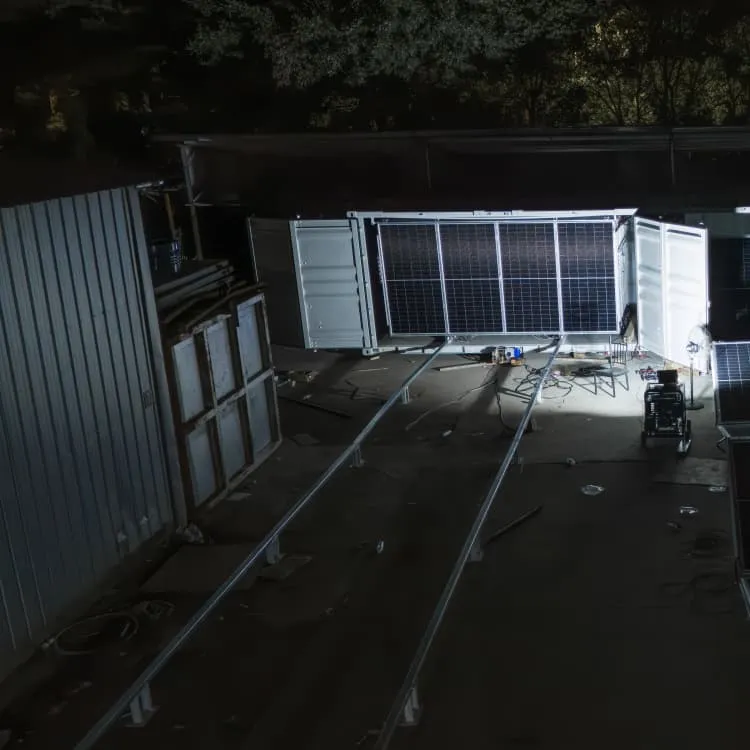

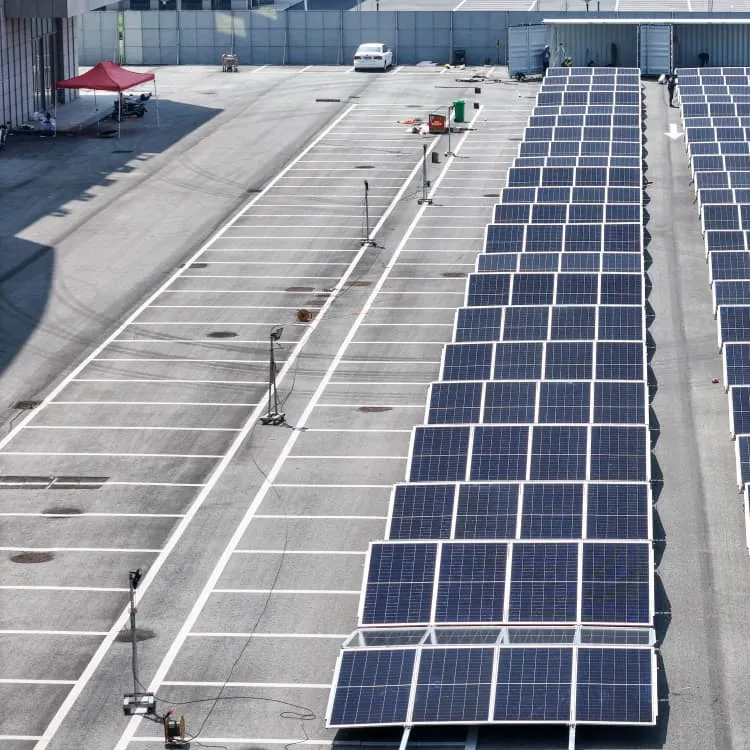

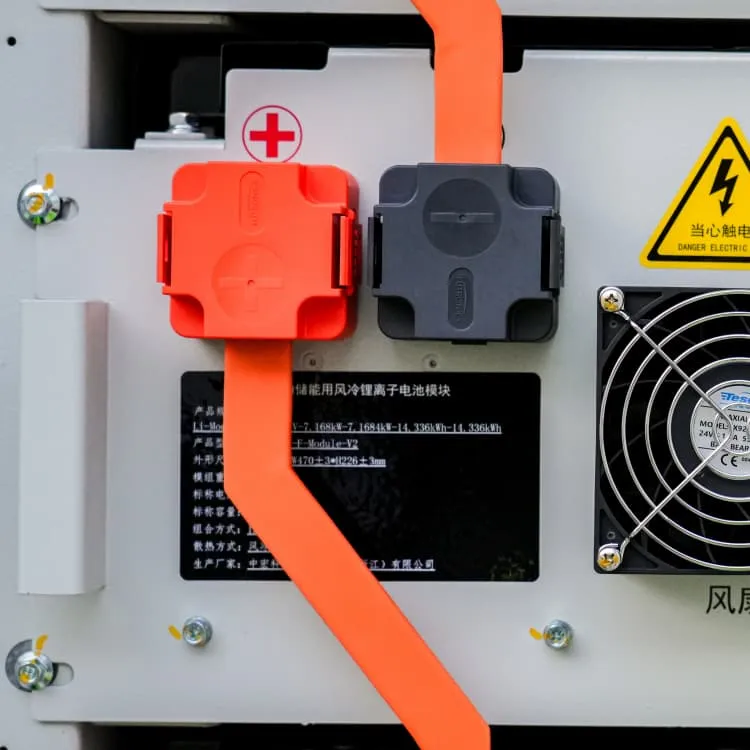

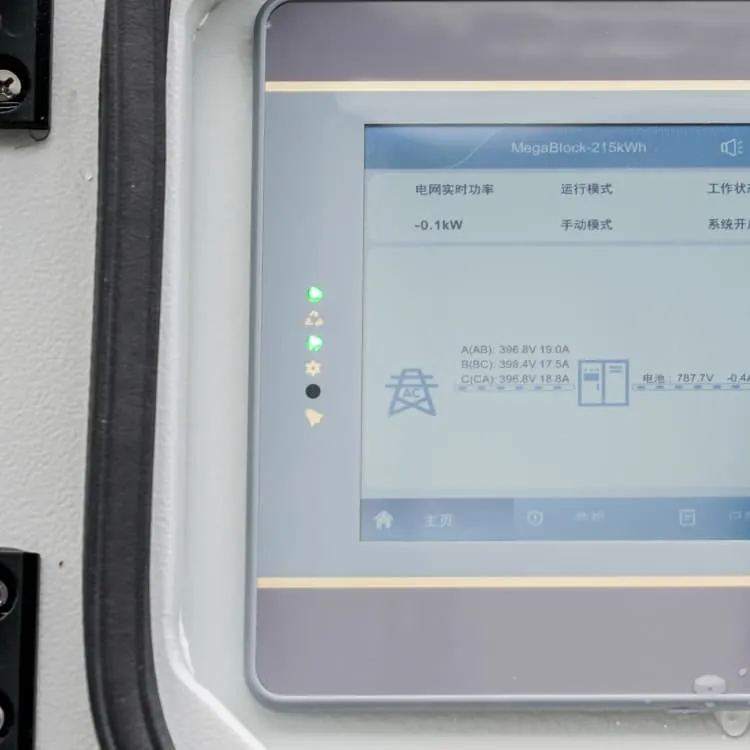

Welcome to our dedicated page for Qatar photovoltaic module export tax rate! Here, we have carefully selected a range of videos and relevant information about Qatar photovoltaic module export tax rate, tailored to meet your interests and needs. Our services include high-quality solar container products and containerized PV solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Qatar photovoltaic module export tax rate, including cutting-edge solar container systems, advanced containerized PV solutions, and tailored solar energy storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial containerized systems, or mobile solar power solutions, we have a solution for every need. Explore and discover what we have to offer!

South Africa''s 10% import tax may hit smaller projects hardest

South Africa''s announced 10% import duty on solar modules poses challenges for developers with tighter profit margins.

Request Quote

Qatar

There are no transfer taxes in Qatar. However, share transfers of state entities require a formal ''No Objection Confirmation'' from the General Tax Authority prior to the

Request Quote

Customers can export surplus energy from photovoltaic

Additionally, the strategy has set a goal to produce 200 megawatts of distributed solar energy systems, allowing customers to connect photovoltaic solar systems to their

Request Quote

Dominant PV Trade Flows In Europe 2022

The past reports6 traces the development over time, while this report focuses on the trade flows of 2022, distinguishing between PV cells and modules. Both of these two extra-European import

Request Quote

Market Opportunity Analysis: Qatar launches national

Qatar as the Middle East GDP per capita ranked first, one of the world''s most promising photovoltaic power producers (annual solar power

Request Quote

The impact of the reduction in export tax rebates for Chinese

On November 15, 2024, China''s Ministry of Finance announced a policy adjustment, reducing the export tax rebate rate for the photovoltaic and battery industries from 13% to 9%. The

Request Quote

Solar exports from China increase by a third

Exports of solar panels from China increased by 34% in the first half of 2023 compared to the same period last year.

Request Quote

Qatar Photovoltaic Market (2025-2031) | Trends, Outlook & Forecast

The Qatar Photovoltaic (PV) Market is experiencing significant growth as the country embraces renewable energy to diversify its energy mix. Qatar commitment to sustainability and reducing

Request Quote

China Lowers Export Rebate Rate, Involving PV Modules and

In the list of products with reduced export rebate rates, PV products include: commodity code 85414200 (solar cells not mounted in modules or assembled into panels) and commodity code

Request Quote

Photovoltaic modules and laminates: Measures in force

"Photovoltaic modules and laminates consisting of crystalline silicon photovoltaic cells, including laminates shipped or packaged with other components of photovoltaic

Request Quote

Qatar Solar Energy

Qatar has been almost solely reliant on its vast gas reserves for power generation for many decades. A key pillar of the National Vision to achieve 20% non-gas energy by 2030

Request Quote

Qatar''s Import/Export Rules: Complete Guide to Trade

Qatar Financial Centre (QFC) entities pay a competitive 10% tax rate on locally sourced profits. The temporary admission regime allows for duty-free importation of goods intended for re

Request Quote

Solar N Plus on LinkedIn: China Reduces Export Tax

The export tax refund rate for certain products, including refined oil, photovoltaic products, batteries, and some non-metallic mineral products, will be reduced

Request Quote

Photovoltaic Panel Export Tax Rebates Key Policies and Industry

Summary: This article explores the latest photovoltaic panel component export tax rebate policies, their global applications, and how businesses in renewable energy sectors can benefit.

Request Quote

Export and Import Regulations in Qatar

Find out important information about export and import regulations in Qatar, including customs, tariffs and points of entry.

Request Quote

Taxes on imported solar panels: Brazil says yes, the

From 2024 to 2027, photovoltaic modules assembled in Brazil will be subject to a 10.8% taxes on imported solar panels.

Request Quote

China to decrease PV product export tax rebate rate

Starting from 1 December 2024, the export tax rebate rate for some refined petroleum products, PV products, batteries and some non

Request Quote

Qatar Customs Import and Export Tax and Fees

This article outlines Qatar''s import and export tax and fee policies, including a standard import tariff of 5% ad valorem and higher protective tariffs for certain goods conflicting with local

Request Quote

Tax rates in Qatar

Currently, Qatar imposes no VAT or sales tax on operations in its territory. However, VAT is expected to be implemented by 2023, since Qatar is part of the GCC VAT framework.

Request Quote

Qatar Customs Import and Export Tax and Fees

Qatar does not levy export duties on goods. This article outlines Qatar''s import and export tax and fee policies, including a standard import tariff of 5% ad valorem and higher protective tariffs for

Request Quote

U.S. anti-dumping ruling challenges Southeast Asian PV exports

On November 29, the U.S. Department of Commerce (DOC) issued a preliminary ruling on the anti-dumping (AD) investigation of crystalline cells from Cambodia, Malaysia,

Request Quote

Qatar Tax Rates

Qatar Personal Income Tax There are no personal taxes, social insurance or other statutory deductions from salaries and wages paid in Qatar. However, income arising from business

Request Quote

Qatar Solar Energy Market

Statistics for the 2025 Qatar Solar Energy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Qatar Solar Energy analysis includes a market

Request Quote

Qatar Tax Tables 2024

Discover the Qatar tax tables for 2024, including tax rates and income thresholds. Stay informed about tax regulations and calculations in Qatar in 2024.

Request Quote

China to decrease PV product export tax rebate rate to 9%

Starting from 1 December 2024, the export tax rebate rate for some refined petroleum products, PV products, batteries and some non-metallic mineral products will be

Request Quote

Qatar

Statistics for the 2025 Qatar Solar Energy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Qatar Solar Energy

Request QuoteFAQs 6

What is the VAT rate in Qatar?

However, the introduction of VAT in Qatar under a common GCC framework is expected to be introduced in the near future. The anticipated tax rate is 5%. Customs duties are applied to goods with an origin outside the GCC countries, normally at a rate of 5%. Higher rates sometimes apply for specific types of goods, such as tobacco products.

Are there transfer taxes in Qatar?

There are no transfer taxes in Qatar. However, share transfers of state entities require a formal ‘No Objection Confirmation’ from the General Tax Authority prior to the transfer being updated in the commercial register. There are no stamp taxes in Qatar.

Which PV products have reduced export tax rebate rates?

According to the above-mentioned government announcements, PV products included in the list of products with reduced export tax rebate rates are for PV cells, either installed or not in modules.

What is the excise tax in Qatar?

Qatar has introduced excise tax from 1 January 2019. Excise tax is applicable on the following goods ('excise goods') at their respective tax rates: Tobacco products: 100%. Carbonated drinks (non-flavoured aerated water excluded): 50%. Energy drinks: 100%. Special purpose goods: 100%.

Are there property taxes in Qatar?

There are no property taxes in Qatar. However, fees may be payable to the government by the owner on the registration of property and by the landlord on the registration of leases. There are no transfer taxes in Qatar.

Are self-employed people taxable in Qatar?

A self-employed individual may be subject to income tax if one derives qualifying income from sources in Qatar, regardless of his/her tax residency. Individuals are taxable in Qatar on their qualifying Qatar-source income, regardless of their tax residence. The rates may be further reduced under a tax treaty.

Related reading topics

- Afghanistan photovoltaic module export company

- Tajikistan monocrystalline solar photovoltaic module export tariffs

- Photovoltaic module export profits

- Photovoltaic module export prices

- Swiss photovoltaic module export company

- Qatar photovoltaic energy storage project construction

- Qatar photovoltaic hybrid power station

- Qatar photovoltaic panel wholesaler