Peak-valley arbitrage in the US energy storage system

Welcome to our dedicated page for Peak-valley arbitrage in the US energy storage system! Here, we have carefully selected a range of videos and relevant information about Peak-valley arbitrage in the US energy storage system, tailored to meet your interests and needs. Our services include high-quality solar container products and containerized PV solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Peak-valley arbitrage in the US energy storage system, including cutting-edge solar container systems, advanced containerized PV solutions, and tailored solar energy storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial containerized systems, or mobile solar power solutions, we have a solution for every need. Explore and discover what we have to offer!

The expansion of peak-to-valley electricity price difference results

Using peak-to-valley spread arbitrage is currently the most important profit method for user-side energy storage. It charges the energy storage power station during the low grid

Request Quote

Energy Storage Arbitrage Under Price Uncertainty: Market Risks

We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization

Request Quote

The value of electricity storage arbitrage on day-ahead markets

Abstract This paper investigates the historical value of electricity storage from the perspective of the storage owner in day-ahead markets (DAM) across Europe. A technology

Request Quote

Peak-Valley Arbitrage

One of the most effective strategies for reducing energy expenses is leveraging energy arbitrage —a method where you take advantage of the price

Request Quote

The expansion of peak-to-valley electricity price

Using peak-to-valley spread arbitrage is currently the most important profit method for user-side energy storage. It charges the energy

Request Quote

Smart Energy Storage | SAV

Customer Value Benefits from Peak-valley Arbitrage: By charging during low electricity price periods and discharging during high electricity price periods, enterprises can maximize the

Request Quote

2023 energy storage installation outlook: China, US, and Europe

On the other side of the coin, abundant residential energy storage systems and modular installation methods accelerate project construction. In the utility-scale energy storage

Request Quote

Peak-Valley Arbitrage

One of the most effective strategies for reducing energy expenses is leveraging energy arbitrage —a method where you take advantage of the price differences between peak and valley

Request Quote

Optimal configuration of industrial user-side energy storage

This paper proposes an optimal configuration model of user-side energy storage aiming at the net present value of the entire life cycle of the energy storage system, and comprehensively

Request Quote

Profitability analysis and sizing-arbitrage optimisation of

This paper explores the potential of using electric heaters and thermal energy storage based on molten salt heat transfer fluids to retrofit CFPPs for grid-side energy storage

Request Quote

Buy Low, Use High: Energy Arbitrage Explained

Simply put, energy arbitrage is a strategic energy purchasing tactic wherein utilities buy power during off-peak hours when grid prices are the cheapest for potential use during

Request Quote

Buy Low, Use High: Energy Arbitrage Explained

Simply put, energy arbitrage is a strategic energy purchasing tactic wherein utilities buy power during off-peak hours when grid prices are the

Request Quote

How much is the peak-to-valley price difference for energy storage

When energy demands peak, storage systems release electricity back into the grid, profiting from the higher sale prices. This process of energy arbitrage relies on accurate

Request Quote

Expert Incorporated Deep Reinforcement Learning Approach for

Peak-valley arbitrage is one of the important ways for energy storage systems to make profits. Traditional optimization methods have shortcomings such as long s

Request Quote

Research on the integrated application of battery energy storage

To explore the application potential of energy storage and promote its integrated application promotion in the power grid, this paper studies the comprehensive application and

Request Quote

Peak valley arbitrage | C&I Energy Storage System

The Article about Peak valley arbitrageBangladesh Huijue Energy Storage Construction: Powering a Sustainable Future A monsoon storm knocks out power lines across Dhaka, but hospitals

Request Quote

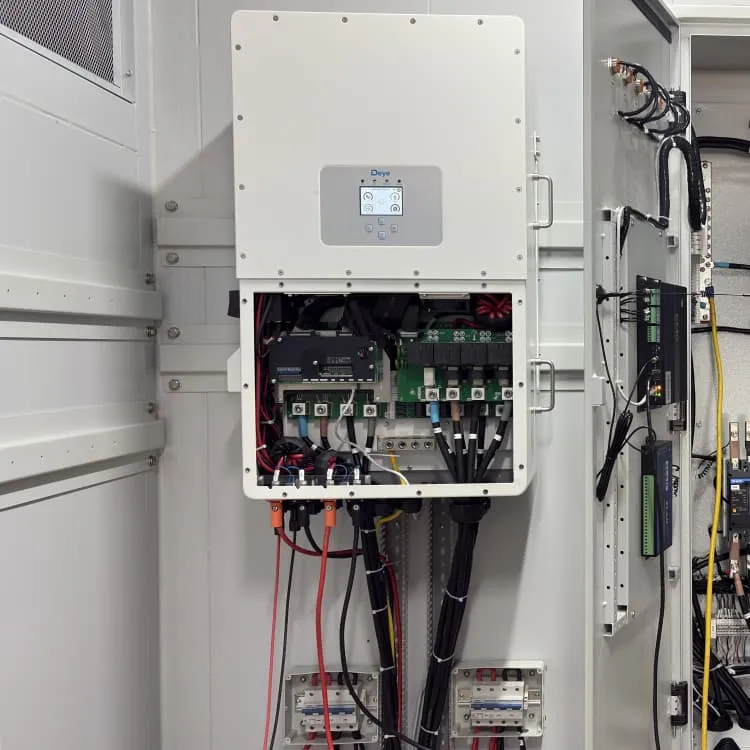

PV-Storage-Charging Integrated System

This system is widely used in charging scenarios where the power distribution capacity is insufficient and the peak-valley price difference is large, bringing

Request Quote

Energy Storage Systems: Profitable Through Peak

Learn how energy storage systems profit through peak-valley arbitrage and distributed energy management.

Request Quote

"peak valley arbitrage" | C&I Energy Storage System

Pyongyang Peak-Valley Off-Grid Energy Storage: Powering the Future Ever wondered how Pyongyang peak-valley off-grid energy storage systems tackle North Korea''s erratic power

Request Quote

Energy storage system: an excellent choice for corporate peak

Let us jointly look forward to the energy storage systems blooming more brilliantly in the corporate peak-to-valley arbitrage field, helping companies achieve double harvests of economic and

Request Quote

Energy Storage Arbitrage Under Price Uncertainty: Market

Abstract—We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization ap-proaches.

Request Quote

6 Emerging Revenue Models for BESS: A 2025 Profitability Guide

Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods (low rates) and

Request Quote

fenrg-2022-907338 1..15

To comprehensively consider the direct income of peak-valley arbitrage and indirect income of energy storage con guration, a coordinated planning model of source-storage-transmission is

Request Quote

Optimized Economic Operation Strategy for Distributed Energy Storage

TL;DR: Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi

Request Quote

Energy Storage Systems: Profitable Through Peak-Valley Arbitrage

Learn how energy storage systems profit through peak-valley arbitrage and distributed energy management.

Request Quote

What Is Energy Arbitrage in Battery Storage?

Discover energy arbitrage strategies to maximize profits and optimize battery storage systems for peak performance.

Request Quote

Economics of electric energy storage for energy arbitrage and

We investigate the economics of two emerging electric energy storage (EES) technologies: sodium sulfur batteries and flywheel energy storage systems in New York state''s electricity

Request Quote

How much is the peak-to-valley price difference for energy

When energy demands peak, storage systems release electricity back into the grid, profiting from the higher sale prices. This process of energy arbitrage relies on accurate

Request QuoteFAQs 6

What is Peak-Valley price arbitrage?

1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods (low rates) and discharging during peak hours (high rates), businesses achieve direct cost savings. Key Considerations:

What is energy arbitrage battery storage?

Energy arbitrage battery storage strategies involve optimizing the charge and discharge cycles of a BESS to maximize profits by taking advantage of price differentials in electricity markets.

What is energy arbitrage?

So what’s the meaning of “energy arbitrage?” Energy arbitrage is the practice of buying electricity when prices are low (often during off-peak hours) and selling it when prices are high (typically during peak demand periods).

What is Bess energy arbitrage?

In the context of battery storage, BESS energy arbitrage involves strategically charging batteries when prices are low and discharging them during peak periods when prices are higher. This approach allows utilities to balance grid demand without engaging in speculative trading, focusing instead on efficiency and operational stability.

How is energy arbitrage calculated?

Energy arbitrage typically occurs in wholesale electricity markets, and profits are calculated by subtracting the cost of purchasing and storing the electricity (including storage losses and operational costs) from the revenue obtained from selling the electricity at higher prices.

Is a retrofitted energy storage system profitable for Energy Arbitrage?

Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage.

Related reading topics

- Tanzania Energy Storage System Peak-Valley Arbitrage Plan

- St Lucia Industrial Energy Storage Peak-Valley Arbitrage Plan

- Percentage of peak-valley arbitrage income for Nicaragua s energy storage system

- Swaziland Energy Storage System Peak-Valley Arbitrage Plan

- Peak-valley arbitrage in the US energy storage system

- Peak-valley wind and solar power and energy storage batteries

- Peak-valley energy storage solution

- Comparison of South Asia and Energy Storage Projects