Third-party investment in energy storage power station projects

Welcome to our dedicated page for Third-party investment in energy storage power station projects! Here, we have carefully selected a range of videos and relevant information about Third-party investment in energy storage power station projects, tailored to meet your interests and needs. Our services include high-quality solar container products and containerized PV solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Third-party investment in energy storage power station projects, including cutting-edge solar container systems, advanced containerized PV solutions, and tailored solar energy storage applications for a variety of industries. Whether you're looking for large-scale utility solar projects, commercial containerized systems, or mobile solar power solutions, we have a solution for every need. Explore and discover what we have to offer!

Fixing Australia''s energy system now with new cheap,

The Albanese Government is delivering enough clean, cheap, reliable renewable electricity to power more than 3 million households, with 19

Request Quote

How do energy storage power stations make money

Energy storage power stations employ various financial models, including capital leasing, third-party ownership, and straight-out purchase

Request Quote

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Request Quote

Research on investment decision-making of energy storage power station

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Request Quote

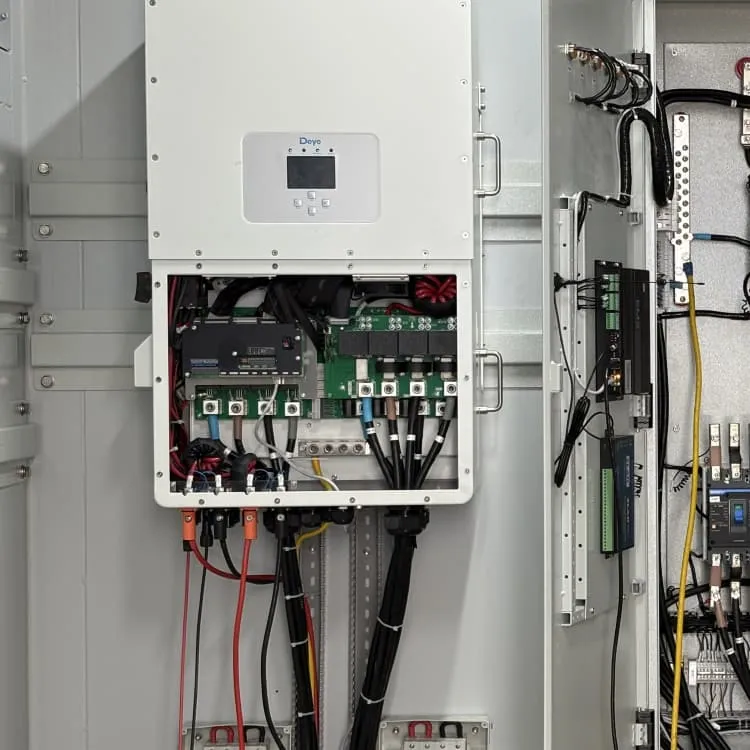

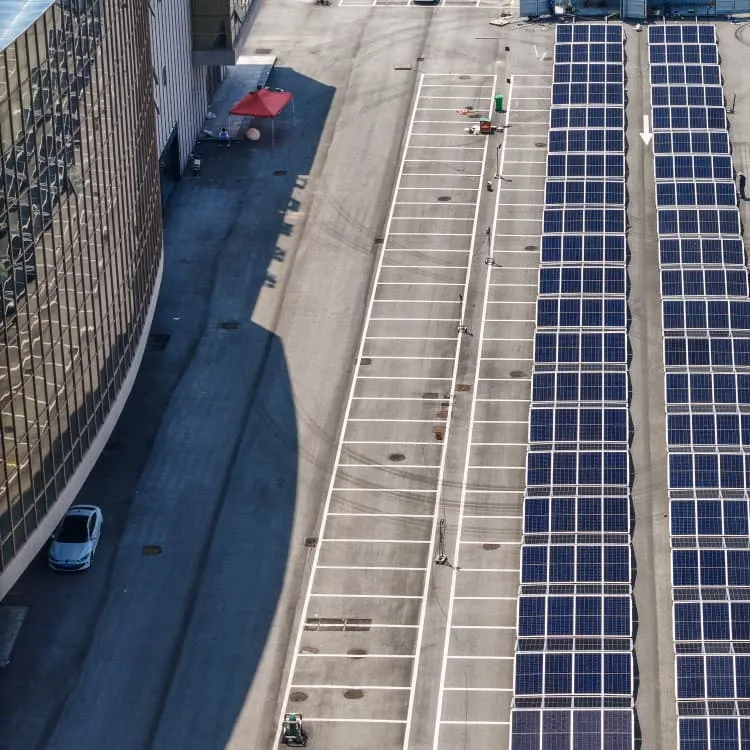

BUSINESS MODELS AND FINANCING INSTRUMENTS IN

Solar carports (can be portable, grid connected or battery stored) Solar PV, battery energy storage, electric vehicles in virtual power plant model in a grid/mini-grid/ microgrid application

Request Quote

Three Investment Models for Industrial and Commercial Battery Energy

In this article, we''ll take a closer look at three different commercial and industrial battery energy storage investment models and how they play a key role in today''s energy

Request Quote

LNG Terminals in China – Project Development, Third Party Access

For third party access at LNG terminals, whether for regasification and/or storage services, there is considerably more ambiguity (and lack of details) on how the authorities will

Request Quote

Pumped storage power stations in China: The past, the present,

The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Request Quote

Swell Energy Raises $120 Million to Bring Total Solar and Battery

Financing to accelerate the company''s mission to deploy 26,000 energy storage systems in homes and businesses and integrate with Swell''s 600MWh of virtual power plants across the

Request Quote

Financing Battery Storage Systems: Options and Strategies

Thinking about Financing Battery Storage Sytems for your commercial or industrial facility? Learn about strategies you have available in this blog and webinar.

Request Quote

National Hydropower Association 2021 Pumped Storage Report

Executive Summary This is the third Pumped Storage Report White Paper prepared by the National Hydropower Association''s Pumped Storage Development Council (Council). The first

Request Quote

An Introduction to Energy Storage

The goal of the DOE Energy Storage Program is to develop advanced energy storage technologies and systems in collaboration with industry, academia, and government

Request Quote

Project Financing and Energy Storage: Risks and Revenue

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and

Request Quote

What are the 8 Different Types of Power Purchase

Gain a deep understanding of how Power Purchase Agreements (PPAs) work and explore the 8 different PPA structures available for renewable energy

Request Quote

Three Investment Models for Industrial and

In this article, we''ll take a closer look at three different commercial and industrial battery energy storage investment models and how they play a

Request Quote

Financing Battery Storage Systems: Options and

Thinking about Financing Battery Storage Sytems for your commercial or industrial facility? Learn about strategies you have available in

Request Quote

ENERGY STORAGE PROJECTS

LPO can finance short and long duration energy storage projects to increase flexibility, stability, resilience, and reliability on a renewables-heavy grid.

Request Quote

What Investors Want to Know: Project-Financed Battery

Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services under regulated

Request Quote

How do energy storage power stations make money through

Energy storage power stations employ various financial models, including capital leasing, third-party ownership, and straight-out purchase agreements. Each of these models

Request Quote

Energy Storage Power Station Projects: The Complete Guide to

Discover how EPC contracts make or break modern energy storage initiatives in an era where global battery capacity is projected to reach 1.8 TWh by 2030 [1]. This guide cuts through the

Request Quote

How to Finance Energy Storage Projects

Learn how to secure energy storage financing for $100M+ projects. Explore project finance, PPAs, green finance incl. incentives, and key industry trends for success.

Request Quote

Optimal siting of shared energy storage projects from a

Therefore, a two-stage multi-criteria decision-making model is proposed to identify the optimal locations of shared energy storage projects in this work. In the first stage, the

Request Quote

Latest Power Generation News and Insights

Power generation industry updates, news, and insights including gas, renewables, coal, nuclear, energy storage, hydrogen, and more.

Request Quote

Research on investment decision-making of energy storage

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Request Quote

Project Financing and Energy Storage: Risks and

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to

Request Quote

External Financing for Energy Projects

This worksheet was informed by Financial Allies working with the Department of Energy (DOE) through the Better Buildings Initiative. It is designed to help organizations select appropriate

Request Quote

The Project Financing Outlook for Global Energy Projects

Recently, there have been a number of energy storage projects financed in Texas utilizing hedge agreements that provide some sort of a

Request Quote

Plug Power claims investment tax credits for US green hydrogen storage

Plug Power claims investment tax credits for US green hydrogen storage facilities, despite Trump-related uncertainties Electrolyser maker has ''boosted its liquidity by

Request Quote

The Project Financing Outlook for Global Energy Projects

Recently, there have been a number of energy storage projects financed in Texas utilizing hedge agreements that provide some sort of a revenue floor, together with market

Request Quote

How to Finance Energy Storage Projects

Learn how to secure energy storage financing for $100M+ projects. Explore project finance, PPAs, green finance incl. incentives, and key industry trends

Request QuoteFAQs 6

Does project finance apply to energy storage projects?

The general principles of project finance that apply to the financing of solar and wind projects also apply to energy storage projects. Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and cashflows of an energy storage project.

Can LPO finance energy storage projects?

LPO can finance short and long duration energy storage projects to increase flexibility, stability, resilience, and reliability on a renewables-heavy grid. Why Energy Storage?

How does a battery energy storage system work?

Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services under regulated frameworks, long-term offtake agreements and merchant schemes. Contracted revenue minimises price volatility.

Will a tax credit be available for energy storage projects?

However, with the passage of the Inflation Reduction Act of 2022, tax credits are now available for standalone energy storage systems, and thus lenders may be willing to provide bridge capital that is underwritten based on the receipt of proceeds from an anticipated tax equity investment, similar to renewable energy projects.

What is energy storage?

Energy storage encompasses an array of technologies that enable energy produced at one time, such as during daylight or windy hours, to be stored for later use. LPO can finance commercially ready projects across storage technologies, including flywheels, mechanical technologies, electrochemical technologies, thermal storage, and chemical storage.

What are the risks of battery energy storage operations 2022?

Research and consultancy group Wood Mackenzie, in its report United States Battery Energy Storage Operations 2022, has identified the following individual operation risks: immature service network, sophisticated battery health monitoring, complex operations bid scheduling, and unique capacity augmentations and overhauls.

Related reading topics

- 400kw energy storage power station investment cost

- Australian energy storage power station investment

- ASEAN Energy Storage Power Station Investment Project

- Samoa energy storage power station investment scale

- Community Energy Storage Power Station Project Investment

- Electric energy storage power station investment company

- Internal investment rate of return of energy storage power station

- What is the appropriate investment size for energy storage projects